|

Overcharts is a fast, intuitive, professional, multiple data-feeds technical analysis and trading platform, designed by traders for traders. Overcharts’ mission is to provide traders the best possible trading experience and chart analysis, all in a single platform and at a reasonable price:

- Simple and intuitive platform

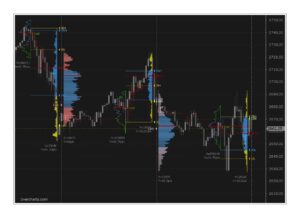

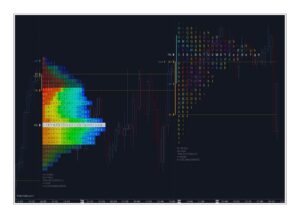

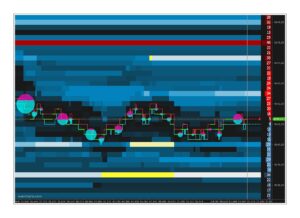

- Powerful charting and indicators

- One click trading from chart and DOM

- Professional volume analysis and cluster (Volume Profile, TPO Profile, Volume Ladder, Bubbles, Market Depth Map, VWAP, Delta etc.)

- Advanced charts & quote board

- Custom indicators

- Multiple brokers and multiple streaming real time data-feeds

- Settings saved on Cloud

- Multiple workspaces with multithread technology

- 4K Ultra HD monitor supported

- Technical support

- Video tutorials

Highlights

Author: Managed WordPress Migration User

The author didnt add any Information to his profile yet